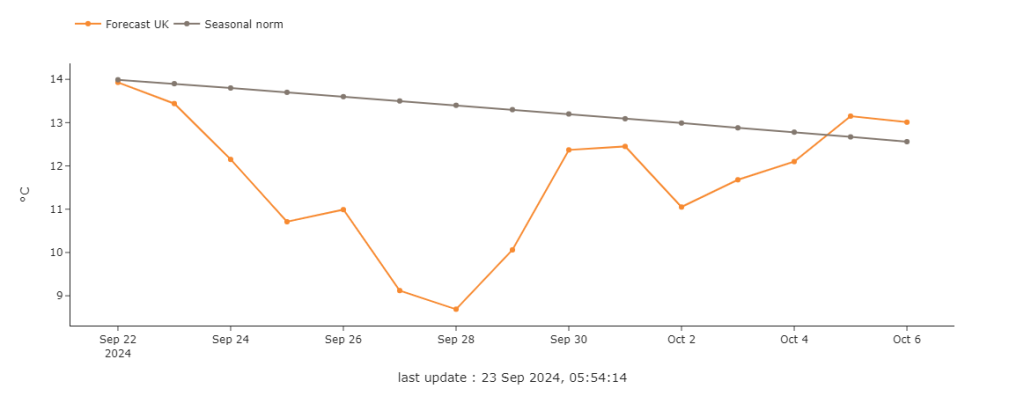

UK Temperature Forecast

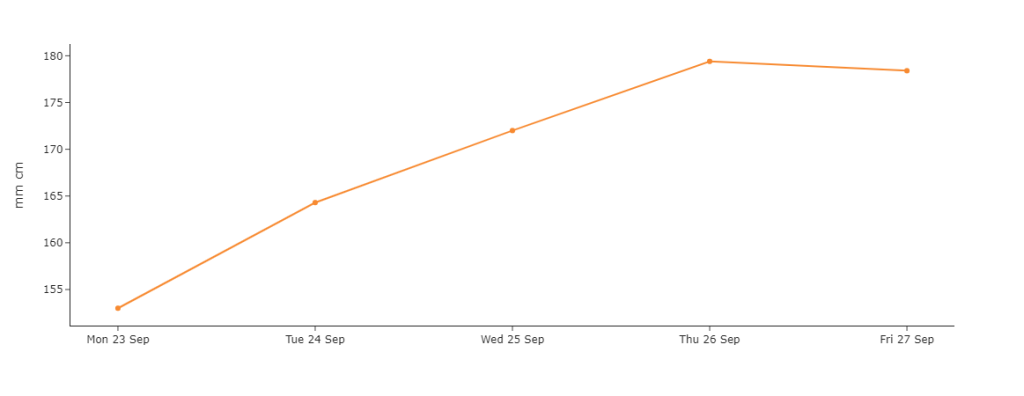

UK 5-day gas demand forecast

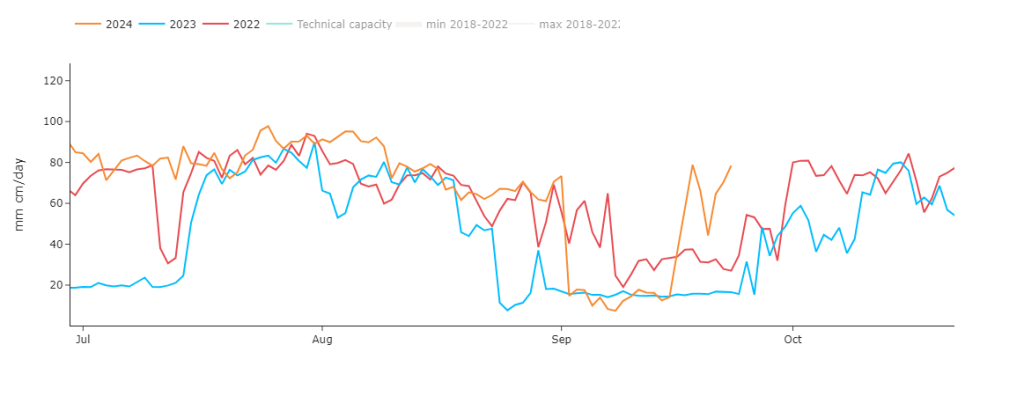

Norwegian gas exports to the UK

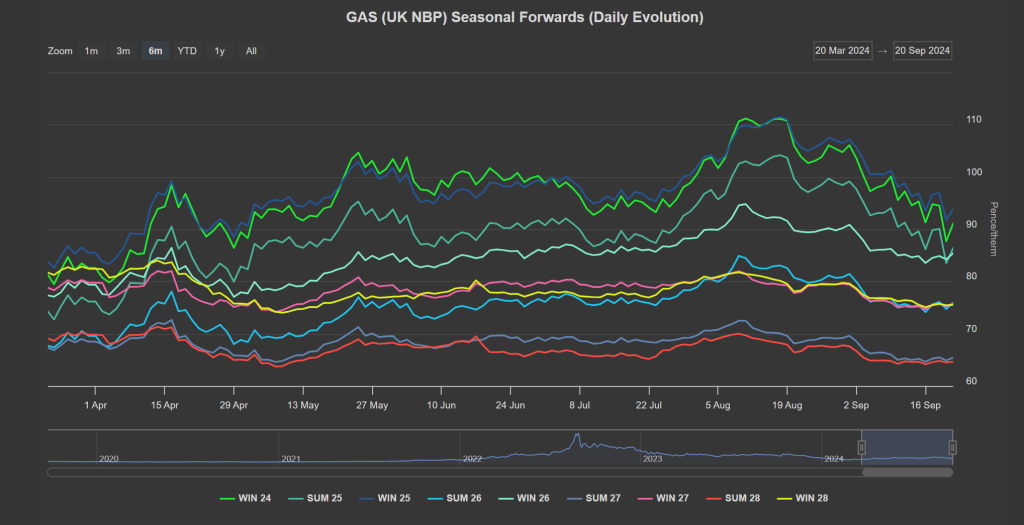

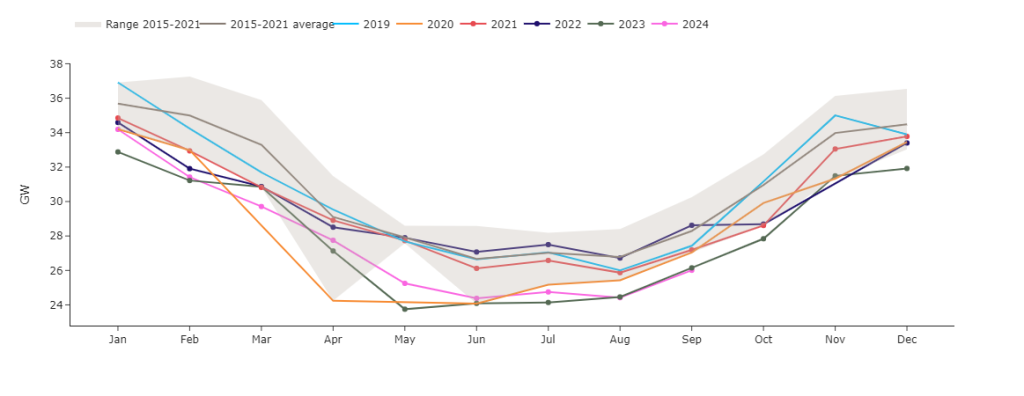

Monthly UK average power load

Share

ICD Energy Managers Limited, Q16, Quorum Business Park, Benton Lane, Newcastle Upon Tyne, NE12 8BX

Website hosted by Zaltek Digital