GAS

- Markets remain on the slide, with near- and far-term prices drifting southwards.

- Prices are down on the week/month/quarter/6-months.

- In short, the bear-trend that began in Q422 is still in place.

- Temperatures are set to peak circa. 7 degrees above seasonal norms into the weekend.

- On the bullish side, wind outputs will drop off circa. 40% today/tomorrow, meaning higher-gas-for-power burn, and potentially increasing the rate of withdrawals.

- Looking to the wide energy complex, European coal supply is in good shape and carbon remains in the duldrums.

- With Summer-24 only 45 days away, only geo-political unrest poses any risk to a continuation of the prevailing bear trend.

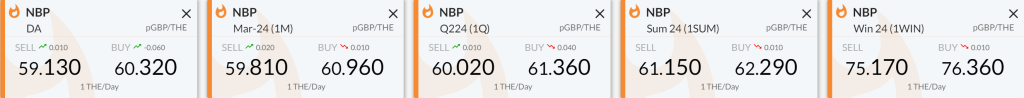

- Monthly Day-Ahead averages are on target this month (so far) to achieve 67p/therm (or circa. 2.25p/kwh).

Gas Context

ELECTRICITY & CARBON

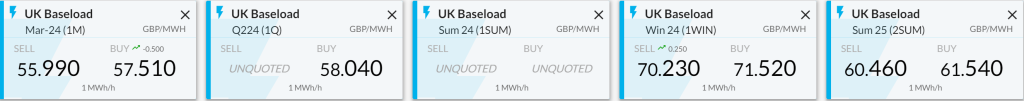

- For the first time since 2018, Seasonal Forwards have assumed a contango state (future delivery prices more expensive than near-term delivery prices) – see chart.

- Looking to the continent, near-term delivery prices dropped again yesterday driven down by weaker fuels and emissions prices along with expectations of slightly higher wind production and nuclear availability.

- With European gas stocks at an all-time high (66% versus the 5-year average of 53%), ongoing Industrial demand destruction and the “solar season” just around the corner with days getting longer, it’s difficult to see where any upward momentum might come from (save geo-political escalations).

- UKAs (UK carbon allowances) are circa. £38/tonne with a retest of 29th Jan lows of £36/tonne surely very likely if EUAs fall further.

- Back in the UK, our generation mix is bang-on neutral with renewables contributing 32% and gas-for-power burn at 32%.

- Monthly Day-Ahead averages for UK electricity are on target this month (so far) to achieve £60/mwh (or 6p/kwh).

Electricity Context

Near-term BUY/SELL prices – LIVE (at the time of writing)

GAS

ELECTRICITY