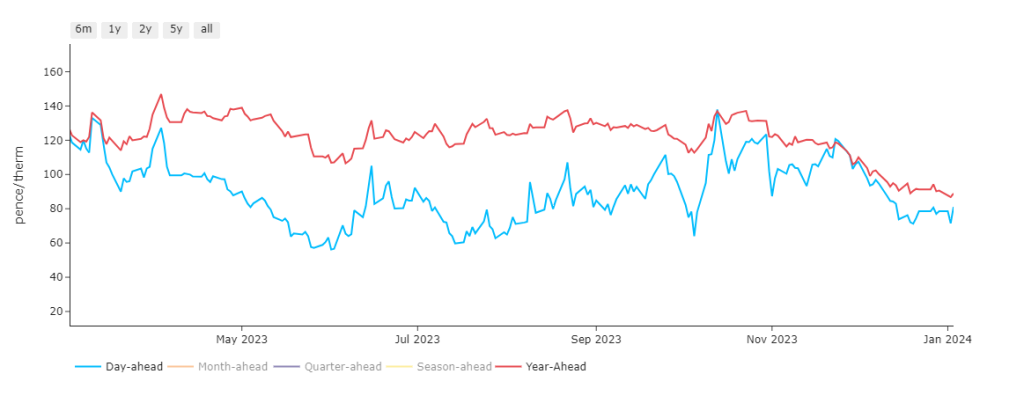

As predicted, markets found support yesterday off the back of rebounding fuels and emissions prices against a backdrop of rising demand, falling wind outputs and worries over Middle East tensions. The short system is being driven primarily by gas-for-power-burn. Norwegian flows and LNG arrivals remain solid. A further 10 LNG arrivals are expected to degasify at UK ports by mid-Jan. Although gas inventories remain at historically high levels for the season, withdrawals will likely increase due to temperatures falling 5°C below normal by Monday of next week. Expect more of the same today – with prices higher at open on a short UK system (demand outstripping supply). Another ship was attacked by Houthi rebels yesterday in and around the Red Sea. Also on the supply-risk side, Norway’s Aasta Hansteen gas field has reduced delivery volumes due to processing issues. As many as 10 LNG vessels could deliver to UK shores by the middle of January. The stong supply and storage dynamic should keep a lid on bullish rallies. Monthly gas Day-Ahead averages are on target to achieve 77p/therm for the month so far. Monthly electricity Day-Averages are on target to achieve £66/mwh for the month so far.

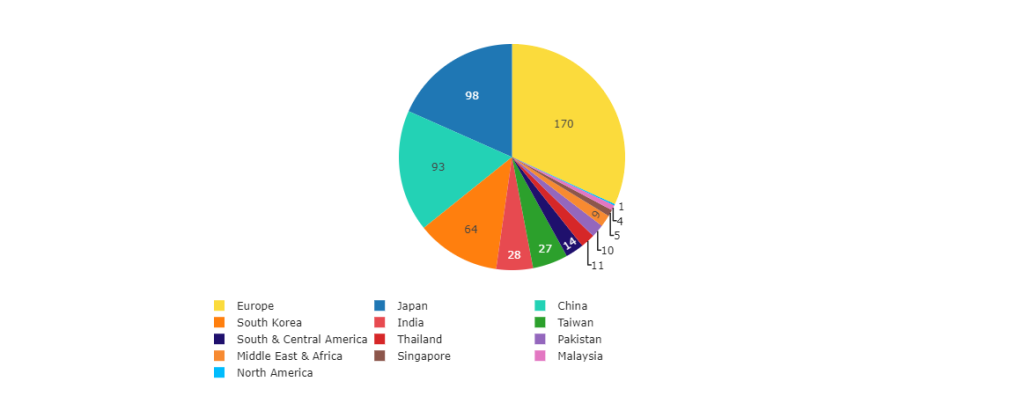

Whilst China’s economy continues to falter weighed down by problems with its property sector (and lower than expected factory outputs), LNG imports are still one of the highest globally. Last year saw an increase of more than 10%. Some forecasters are projecting a rise by another 20% in the next couple of years, then almost double by 2030. For our part, we remain sceptical at these numbers – as China’s outputs will only increase if they have destinations for their exports! (chart below BCM, billion cubic metres, 2022).

Share

ICD Energy Managers Limited, Q16, Quorum Business Park, Benton Lane, Newcastle Upon Tyne, NE12 8BX

Website hosted by Zaltek Digital