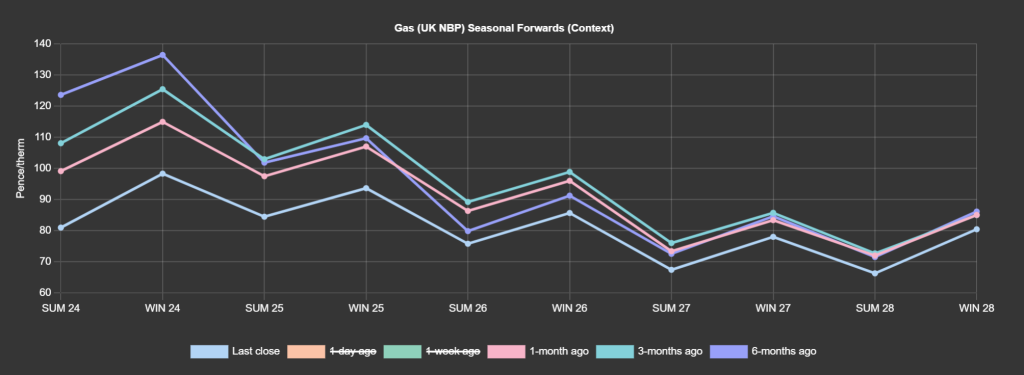

Overwhelmingly bearish fundamentals continued to weigh on both near- and far-term delivery gas prices over the festive break – lingering weak demand and sustained strong wind outputs limited any potential upside. As such, Seasonal Forwards are down versus 1-month ago/3-months ago/6-months ago (see chart). However, we’re now in the thick of Q1 (traditionally the period of highest demand), so a retest of the highs set back in October ’23 can’t be discounted. We’re told to expect some colder, stiller weather towards the back end of this week with both temperatures and wind outputs set to drop below seasonal norms – increasing gas-for-power burn, heating demand and, of course, storage withdrawal. For the time being, European storage remains comfortable at 86% fullness versus the 5-year average of 74%. This morning, near-term delivery contracts are trading up at 80p/therm (versus December’s achieved monthly Day-Ahead average of 84p/therm). Rising tensions in the Middle East have lent support to front-month delivery contracts which are circa. 4p/therm higher than yesterday’s close. Specifically, Iran have sent a warship into the Red Sea forcing Maersk to suspend their shipping route in that area. Supply is outstripping demand this morning, with the UK system marginally long. LNG send-outs remain steady and Norwegian flows persist at capacity. Looking to the continent for signals, colder weather is forecast from next week up until mid-January. Notably, LNG arrivals to NW Europe have declined and are more than 30% down versus the 30-day average. In short, all it will take are weaker outputs and increased demand against a backdrop of deteriorating geopolitical drivers to encourage the bulls to retest last October’s highs…

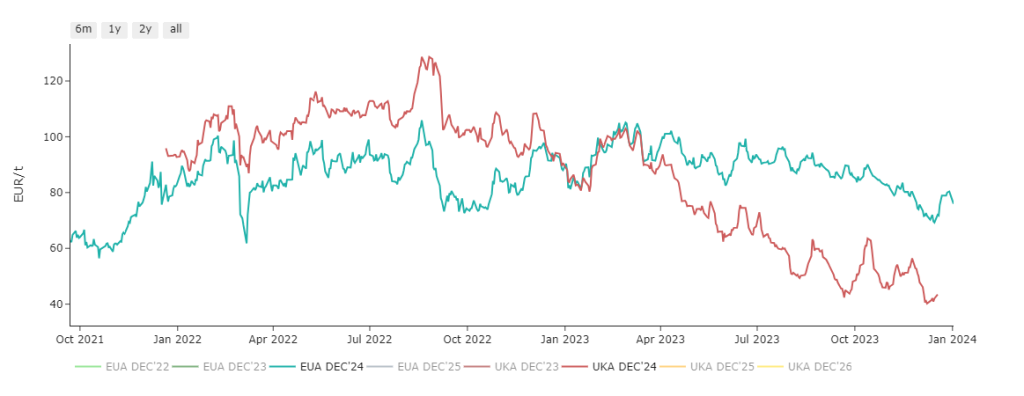

As you’d expect, electricity prices have been tracking gas movements. Monthly Day-Ahead averages for December ’23 came in at a very welcome £69/mwh (or 6.9p/kwh). Notably, Winter ’24 delivery prices have fallen 30% versus those printed back on 13th Oct ’23. Whilst Summer ’24 prices have fallen nearer to 40%! Looking short-term, expectations of stronger demand in the coming days have so far been tempered by steady renewables generation and solid French nuclear availability, keeping intraday prices at rock-bottom in the early hours of the morning. On the continent, a noticeable drop of wind output forecasted for tomorrow combined with rising demand with people returning to work is likely to further support the market today. Back in the UK, our generation mix at the time of writing is fairly neutral, with 35% gas-for-power burn; 27% renewables and 25% low-carbon (nuclear and imports). Looking to the impact on UKAs (mandatory carbon allowances), European allowances remain at a marked premium (see chart). December saw further lows attributed in the main to investors resuming their short position after profit-taking that took place in the last two weeks of the year. The drop is regarded nonetheless as exaggerated considering the higher residual power demand expected in the coming weeks and the lack of auction supply until mid-January (exacerbating scarcity). The resumption of the auctions on 15th Jan ’24 is likely to resume pressure on carbon prices, and the current market consensus is that fundamentals do not justify prices above £50/tonne.

Share

ICD Energy Managers Limited, Q16, Quorum Business Park, Benton Lane, Newcastle Upon Tyne, NE12 8BX

Website hosted by Zaltek Digital