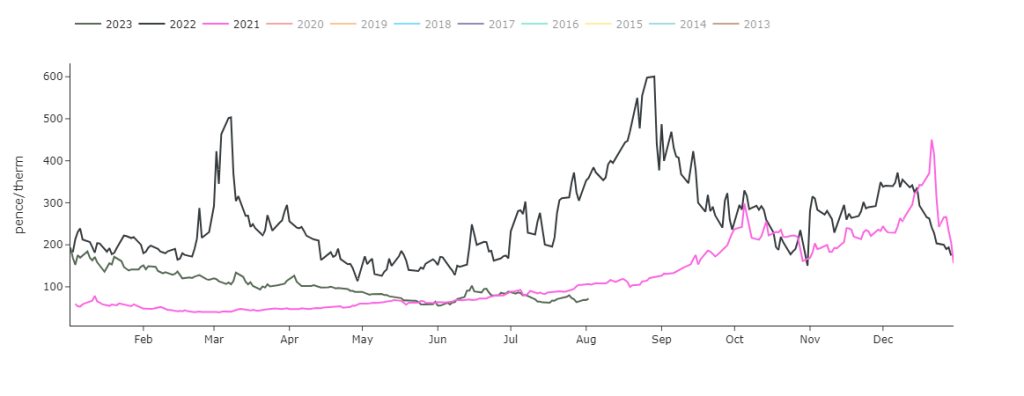

Month-Ahead prices are now comfortably below those posted in 2021 (see chart) – proof (if proof were needed), that at least where near-term delivery is concerned (Day-Ahead/Month-Ahead), the market resembles pre-pandemic/pre-invasion levels. A contango state persists at the front three seasons (Winter ’23/ Summer ’24/ Winter ’24), with Summer ’24 still at a premium to Winter ’23 – making Summer ’24 an unattractive hedge for buyers, especially considering that the Day-Ahead average performance for Summer ’23 so far is at 78p/therm versus prevailing Forward prices for Summer ’24 at 124p/therm. European storage is at 86% versus the 5-year average of 71%. Above average seasonal temperatures are forecast beginning 9th August, set to persist for several weeks thereafter. Outlook remains neutral to bearish with 56 days of Summer ’23 remaining. Unweighted monthly (Heren) Day-Ahead averages are on target (this month) to achieve 67p/therm (or 2.3p/kwh).

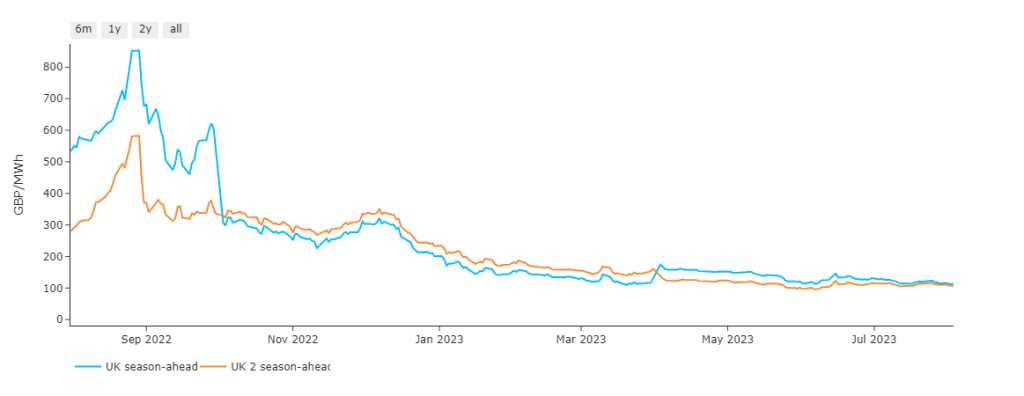

Notably, Season-Ahead and Two-Seasons-Ahead are pretty much at parity (see chart) – this is unusual price-action, as ordinarily whilst in summer, one would expect to see Two-Seasons-Ahead at a marked divergence below Season-Ahead – however, given the inflation of next summer’s Forward price (primarily linked to geo-political uncertainty over the coming winter), the two lines have converged as opposed to maintaining divergence up to the point of season-switch. Delivery prices for the front three seasons are down on the month, and comparative value can still be hedged for Summer ’24. Renewables outputs are steady, limiting gas-for-power generation. On the continent, a significant renewables surge is expected to exert pressure on prices, coupled with lower holiday demand. Solar generation is forecast to remain high for the rest of August though support remains over worries of a second wave of Norwegian outages expected later this month, limiting supply. Back in the UK, outlook remains neutral to bearish with unweighted monthly (N2EX) Day-Ahead averages on target to achieve £70/mwh (or 7p/kwh).

Share

ICD Energy Managers Limited, Q16, Quorum Business Park, Benton Lane, Newcastle Upon Tyne, NE12 8BX

Website hosted by Zaltek Digital