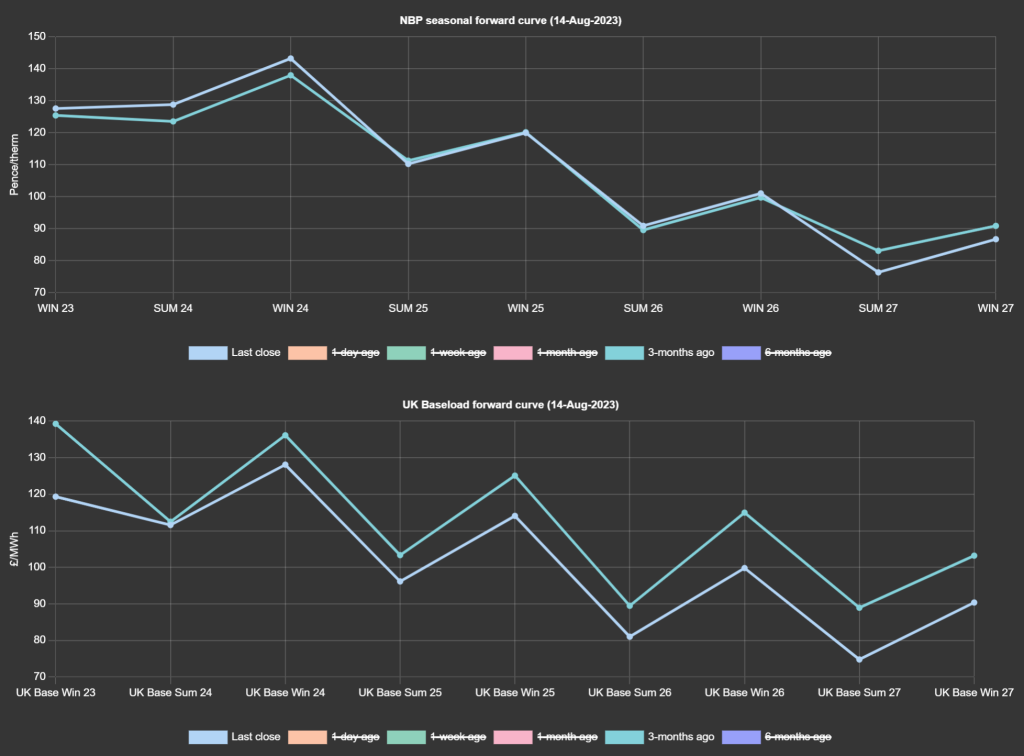

Notably, whilst seasonal gas prices (top black chart) are above those printed 3-months ago for the front three seasons (Winter’23/Summer’24/Winter’24), electricity prices (lower black chart) remain below those printed 3-months ago (and all the way down the curve) – reflecting an increasingly pronounced risk-premium for gas delivery as we draw closer to Winter ’23.Whilst electricity prices still offer comparative value for buyers, gas prices remain supported following Wednesday’s bullish reaction to news of potential workers’ strikes at Australian LNG plants (limiting supply) – union leaders will be meeting tomorrow to attempt to broker an agreement on salaries and working conditions.More volatility is anticipated this week with further scheduled Norwegian maintenance at the Kårstø processing complex – reducing production (and gas flows) by 11.6 mcm/d (million cubic metres per day) for the period 15th Aug to 1st Sep.Despite concerns of supply tightness, European storage is now at 89% versus the 5-year average of 75% – on the brink of achieving the Winter ’23 target of 90% six weeks ahead of schedule.Unweighted (Heren) monthly Day-Ahead averages are on target to achieve 75p/therm (or 2.5p/kwh).Outlook is neutral with contango state persisting at the front of the curve and not a lot of time left for prices to test the Summer ’23 lows set back in May.

UKAs have achieved record lows versus their introductory price posted back in mid-’21 when UK-ETS was first introduced – this in comparison to EUAs (their European counterpart) which has maintained its high trading range (see chart compiled in EUROs). The bearish price action is a result of dried-up speculative interest, solid renewables outputs having pressured demand from UK electricity buyers, and the subdued levels of UK industrial outputs leading to lower mandatory allowance buying (softening demand) – recent PMI figures indicate further decline in the manufacturing industry with lower production, lower orders, lower employment against a backdrop of weak domestic/overseas demand. In all, UKAs are now at a 53% discount versus the highs of £85/tn posted back in Feb ’23.

Share

ICD Energy Managers Limited, Q16, Quorum Business Park, Benton Lane, Newcastle Upon Tyne, NE12 8BX

Website hosted by Zaltek Digital

Briar Chemicals’ CEO explains ICD’s supporting role in an interview for Manufacturing Today magazine