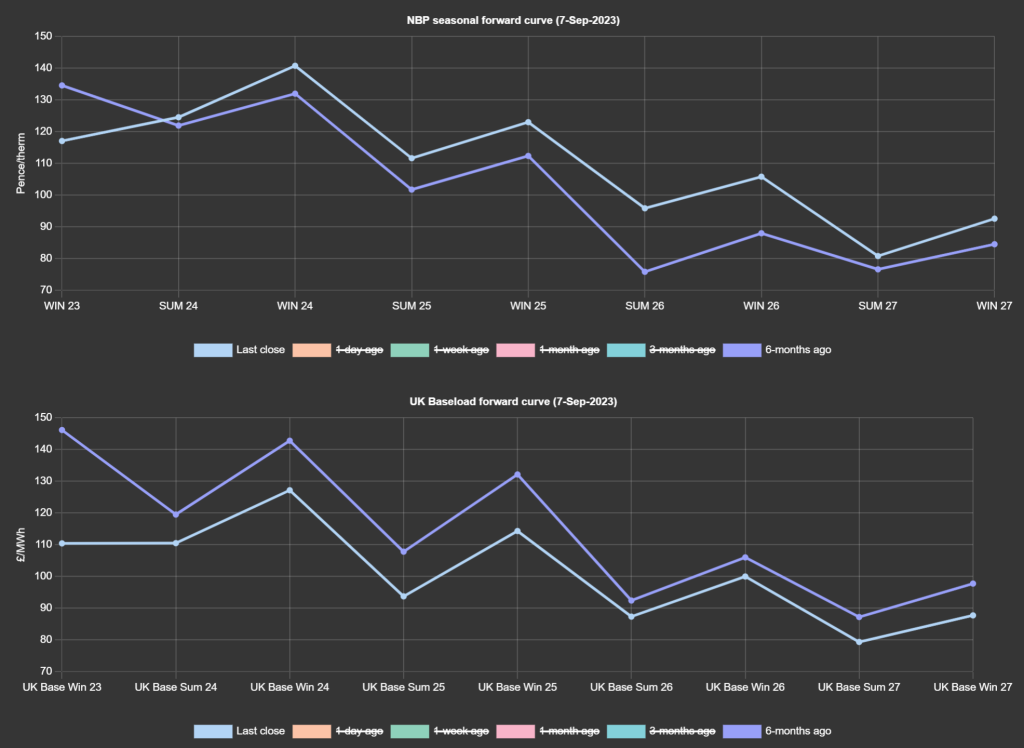

Whilst seasonal gas Forwards (upper section of chart) are now above those printed 6-months ago for all delivery periods down the curve (excluding Winter ’23), electricity prices (lower section) remain below those printed 6-months ago – reflecting an ongoing risk-premium for gas delivery as we draw closer to Winter ’23. Whilst electricity prices still offer comparative value for buyers for Summer’24/Winter ’24, the same cannot be said for gas prices – especially when you consider that monthly gas Day-Ahead averages for the last 12 months are at 128p/therm (including the highs of Q422). Markets remain uncertain if LNG supply tightness (7% global capacity) will be caused by strikes at two Australian (Chevron) LNG plants – negotiations are ongoing. China’s ambiguous economic data releases are also contributing to volatility – both exports and imports for August were down on the year by circa. 8%, but crude oil imports were up 30% for the same period! Fundamental drivers remain primarily bearish – with European storage at 92% versus the 5-year average of 82%; warm weather and solid supply supply-demand dynamics. Unweighted gas (Heren) monthly Day-Ahead averages are on target to achieve 82p/therm (or 2.8p/kwh). Outlook is neutral with contango state persisting at the front of the curve and not a lot of time left for prices to test the Summer ’23 lows set back in May.

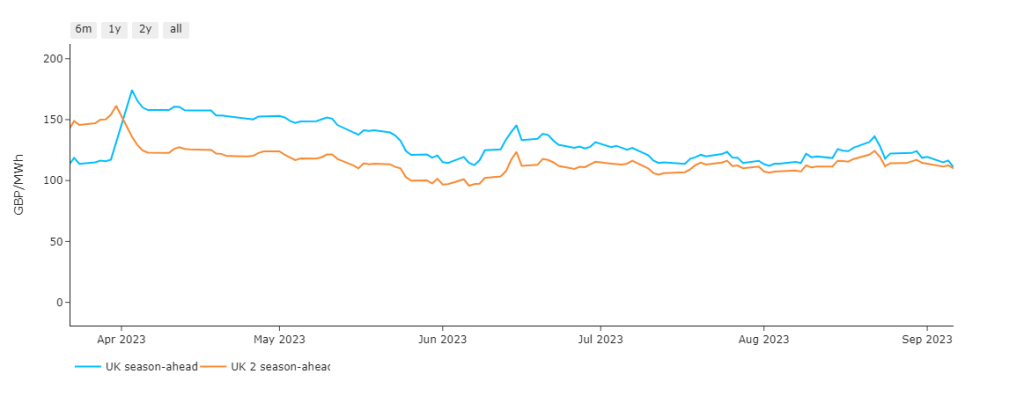

Ordinarily, whilst still in summer heading toward winter (season-ahead), you’d expect to see 2-seasons ahead (Summer’ 24) at a considerable discount. However, given prevailing geo-political uncertainty and fears of winter supply tightness, season-ahead/2-seasons ahead are now at parity (see chart). Are we really to expect a Summer ’24 that will be as expensive as Winter ’23? It all depends on how temperatures play out across Europe over the coming months, and how storage holds up if/when a cold spell hits. We could also do without any unexpected damage to global gas transit infrastructure i.e., exploding pipelines and/or LNG terminals (such as we’ve seen over the last couple of years)! Unweighted (N2EX) monthly Day-Ahead averages are on target to achieve £87/mwh (or 8.7p/kwh). Outlook remains neutral with the Winter ’23 delivery having traded in a tight range between £140/mwh and £114/mwh since May ’23.

Share

ICD Energy Managers Limited, Q16, Quorum Business Park, Benton Lane, Newcastle Upon Tyne, NE12 8BX

Website hosted by Zaltek Digital