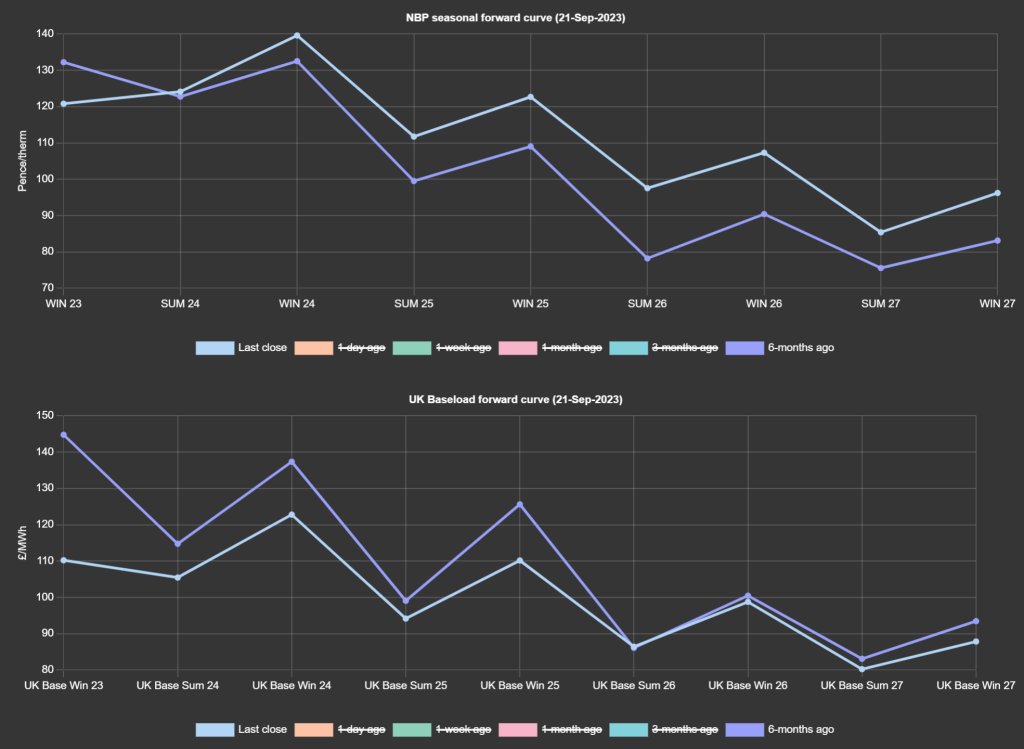

Whilst seasonal gas Forwards (upper section of chart) are now above those printed 6-months ago for all delivery periods down the curve (excluding Winter ’23), electricity prices (lower section) remain below those printed 6-months ago – reflecting an ongoing risk-premium for gas delivery as we draw closer to Winter ’23. Whilst electricity prices still offer comparative value for buyers for Summer’24/Winter ’24, the same cannot be said for gas prices – especially when you consider that monthly gas Day-Ahead averages for the last 12 months are at 128p/therm (including the highs of Q422). Down the curve, delivery prices are trading lower on increasingly positive noises coming out of Australia. The Fair Work Commission are encouraging Chevron and the labour unions to conclude negotiations and arrive at a settlement, issuing a deadline of 9am on Friday (Perth time). Scheduled Norwegian maintenance outages are slowly drawing to a close, with the Troll field resuming operations, easing supply tightness. Unweighted gas (Heren) monthly Day-Ahead averages are on target to achieve 88p/therm (or 3p/kwh). Outlook is neutral with contango state persisting at the front of the curve and not a lot of time left for prices to test the Summer ’23 lows set back in May.

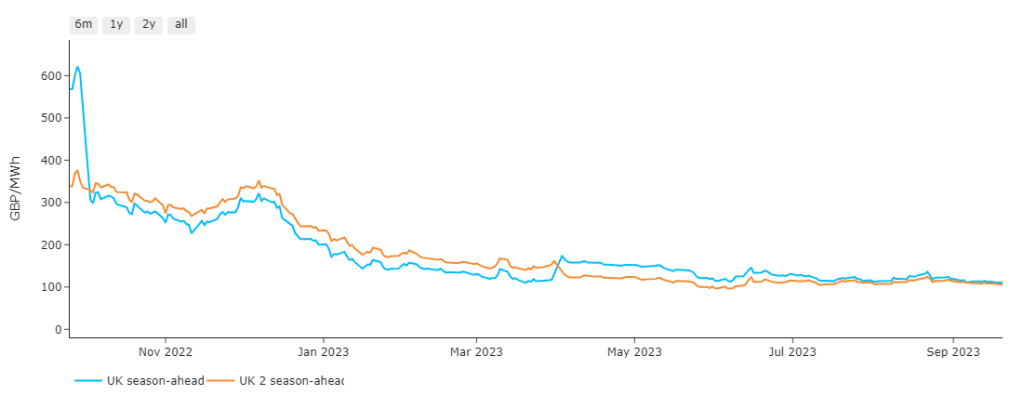

Ordinarily, whilst still in summer heading toward winter (season-ahead), you’d expect to see 2-seasons ahead (Summer’ 24) at a considerable discount. However, given prevailing geo-political uncertainty and fears of winter supply tightness, season-ahead/2-seasons ahead are now at parity (see chart). Are we really to expect a Summer ’24 that will be as expensive as Winter ’23? It all depends on how temperatures play out across Europe over the coming months, and how storage holds up if/when a cold spell hits. We could also do without any unexpected damage to global gas transit infrastructure i.e., exploding pipelines and/or LNG terminals (such as we’ve seen over the last couple of years)! Unweighted (N2EX) monthly Day-Ahead averages are on target to achieve £85.8/mwh (or 8.58p/kwh). Outlook remains neutral with the Winter ’23 delivery having traded in a tight range between £140/mwh and £114/mwh since May ’23.

Share

ICD Energy Managers Limited, Q16, Quorum Business Park, Benton Lane, Newcastle Upon Tyne, NE12 8BX

Website hosted by Zaltek Digital