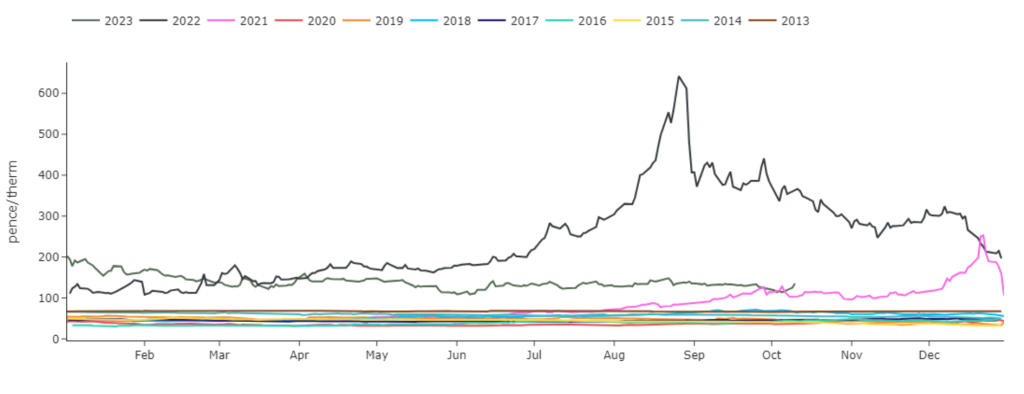

Looking at the bigger picture (see chart), Year-Ahead prices have now returned to levels seen at the post-pandemic demand surge in Oct’21. Year-Ahead prices fell below 200p/therm in the early days of 2023, thereafter, drifting lower printing a bottom of 108p/therm in early June – but failing to get anywhere near a break below the psychological level of 100p/therm. Likewise, the major level of upside resistance is 200p/therm as we approach Winter ’23 conditioning (with significant premium still attached to the colder months of Q124). Whilst Year-Ahead delivery prices are circa. 100% higher than pre-pandemic levels, it’s important to note that prevailing rates are at an 89% discount versus the historical highs printed on 26th Aug ’22. Contracts have been trading higher down the curve this week supported by likely strikes of up to 500 workers at two Australian (Chevron) LNG sites. As a consequence of the Gaza conflict, production at the Tamar field in Israel has been halted. Not surprisingly, front-month (November) rates saw an increase over the last few days with forecasts of below average temperatures next week. LNG cargos are in good shape with global LNG imports having increased by 9% over the past week. LNG at European ports waiting to be re-gasified is up 14%. However, supply risks persist with 15-20% of LNG cargos to Europe transiting via the Suez Canal, so expansion of the conflict in the Middle East could lead to problems. The UK is expecting five more LNG deliveries this month. European storage is at 97% versus the 5-year average of 89%. Monthly Day-Ahead averages are on target to achieve 84p/therm (or 2.9p/kwh) versus Month-Ahead of 108p/therm (or 3.7p/kwh). With the onset of Winter ’23, outlook is bullish.

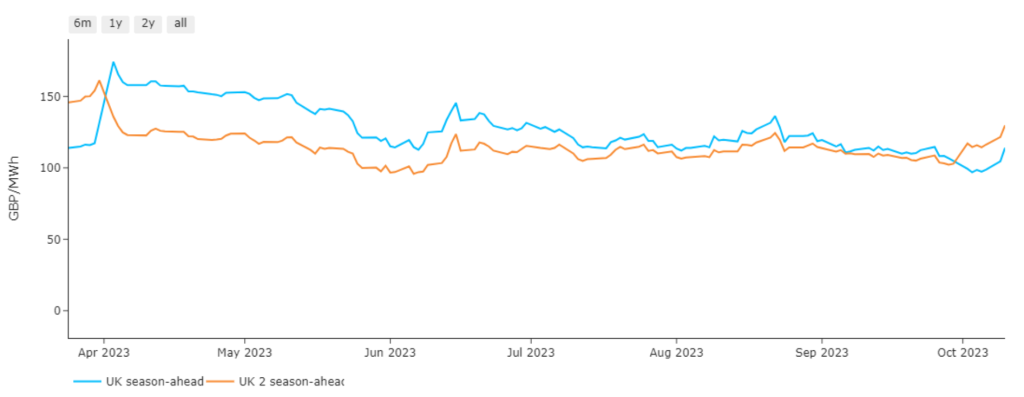

It’s business as usual (now that the Winter ’23 transition is upon us), with Summer ’24 delivery at a marked discount to Winter ’24 delivery (see chart). Recent weeks saw the front 2-seasons at parity, but the Forwards picture invariably becomes a lot clearer when temperatures drop, and heating load demand picks up. Whilst near- and far-term prices are always expected to rise over the winter months, the big question is how high will they go, given the context of historically high gas storage levels and solid supply/demand dynamics? Also, how will Day-Ahead prices perform if short-term risk remains fairly benign? Will we see a repeat of Winter ’22 when Day-Ahead outperformed Forward prices that had been available throughout the preceding summer? UK wind outputs are forecast to fall until 17th of this month, picking up thereafter for a week or so. Monthly Day-Ahead averages are on target to achieve £74/mwh (or 7.4p/kwh) versus Month-Ahead at £114/mwh (or 11.4p/kwh). Outlook is bullish with the onset of Winter ’23.

Share

ICD Energy Managers Limited, Q16, Quorum Business Park, Benton Lane, Newcastle Upon Tyne, NE12 8BX

Website hosted by Zaltek Digital

Briar Chemicals’ CEO explains ICD’s supporting role in an interview for Manufacturing Today magazine