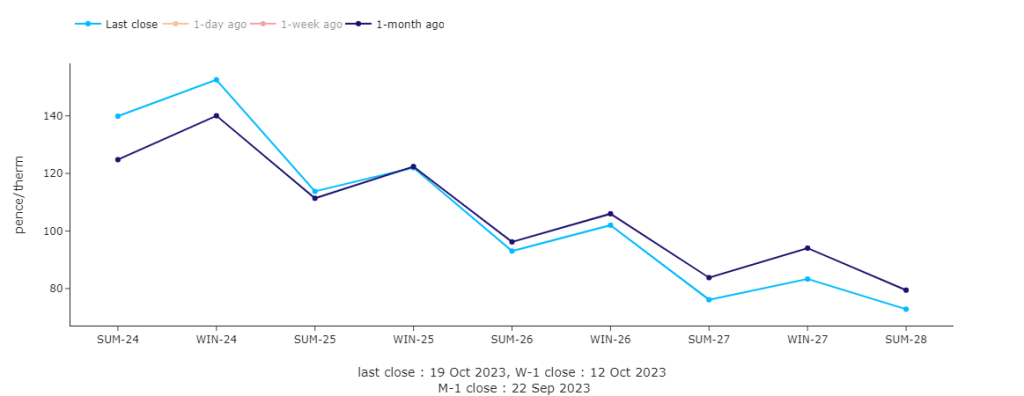

Despite fundamentally bearish drivers, winter-fever is upon us, and heightened speculation has meant a surge in front-end pricing over the last couple of weeks (see chart). European gas storage is at 98% versus the 5-year average of 90%. Temperatures remain above seasonal norms and are forecast to remain so into next week. You only need to look out your window to see Storm Babet’s high winds, meaning of course gas for power demand has dropped off a cliff. Norwegian pipeline flows are in good shape; LNG arrivals into the UK are steady with seven more cargos expected to re-gasify before month-end; Chevron Australia LNG unions agreed a deal this week at the eleventh hour to prevent strikes resuming. So, all in all, pretty bearish – but the context of winter expectations and speculative fervour is keeping front-end delivery supported. Having said that, prices yesterday traded sideways and today looks set be relatively directionless too. Such rangebound trading reflects the uncertainty of the market, pressured by bearish fundamentals but supported by winter-context and the fear of risks of escalation across the Middle East. Day-Ahead continues to outperform Month/Quarter/Season/Year-Ahead/Summer’25/Winter’25 – with Oct ’23 monthly Day-Ahead averages (Heren) on target to achieve circa. 100p/therm (3.5p/kwh), matching Oct ’22. Outlook is bullish as we head deeper into Winter ’23.

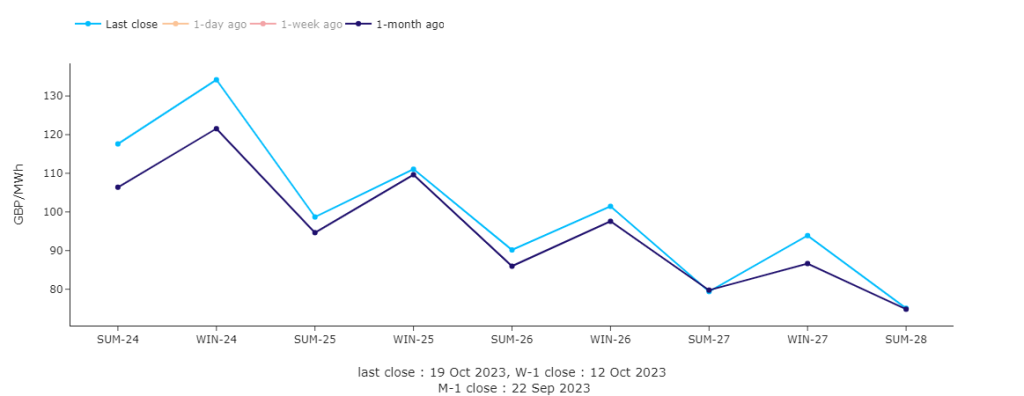

On the continent, European spot prices have been supported by expectations of weaker French nuclear availability and solar generation, and pressured by easing demand borne of rising wind outputs and gas prices. Next week however, it’s likely that short-term delivery will continue to find support in solid renewables generation along with stronger demand, although the bullish momentum should be tempered by improved hydro generation and French nuclear availability. Back in the UK, the generation mix today comprises 15% fossil fuels; 54% renewables; 19% low-carbon (nucelar and imports); 7% biomass. Monthly Day-Ahead averages (N2EX) are on track to achieve £78/mwh (or 7.8p/kwh). With the onset of winter-conditioning, Forward seasonal prices are higher all the way down the curve (see chart). There’s very little hedging going on right now, with Winter ’24 looking inflated, though there’s some great value to be had for delivery Summer ’26 onwards. Outlook is bullish.

Share

ICD Energy Managers Limited, Q16, Quorum Business Park, Benton Lane, Newcastle Upon Tyne, NE12 8BX

Website hosted by Zaltek Digital

Briar Chemicals’ CEO explains ICD’s supporting role in an interview for Manufacturing Today magazine