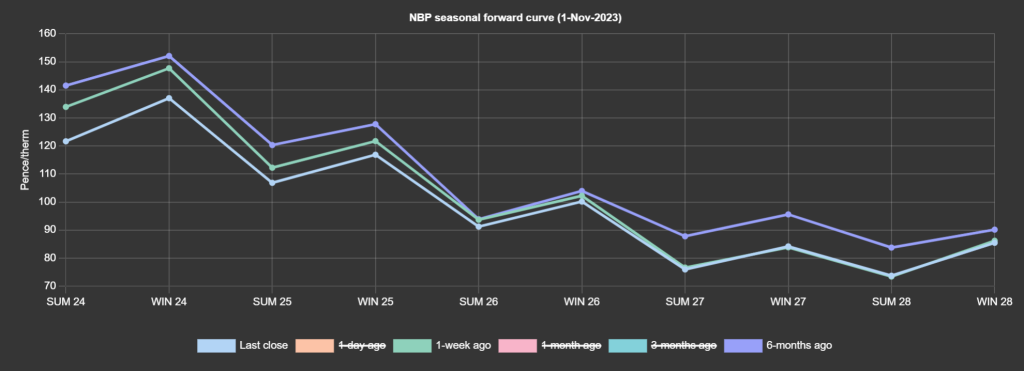

It’s been a mixed week on the gas markets – though seasonal forward prices are down on the week, and significantly down versus 6-months ago (at the start of Summer ’23) – see chart. The Gazan conflict and fears of unrest spreading across the Middle East continues to lend price support to global commodities, though key drivers remain bearish with near-term delivery gas contracts under pressure. Norwegian gas flows are back on track, having edged back above their 5-day moving average. European gas inventories are at 99% fullness versus the 5-year average of 90%. The UK system is “long” today, with supply outstripping demand against a backdrop of Storm Ciaran’s mild, wet and windy conditions limiting gas-for-power burn. LNG send out continues to improve across Europe and the UK. In short, if the Gazan conflict wasn’t happening, bearish fundamentals would be dragging the market much lower. As things stand, monthly (Heren) Day-Ahead averages for Oct ’23 came in at 106p/therm (or 3.6p/kwh). Outlook is neutral pending what happens next in the Middle East.

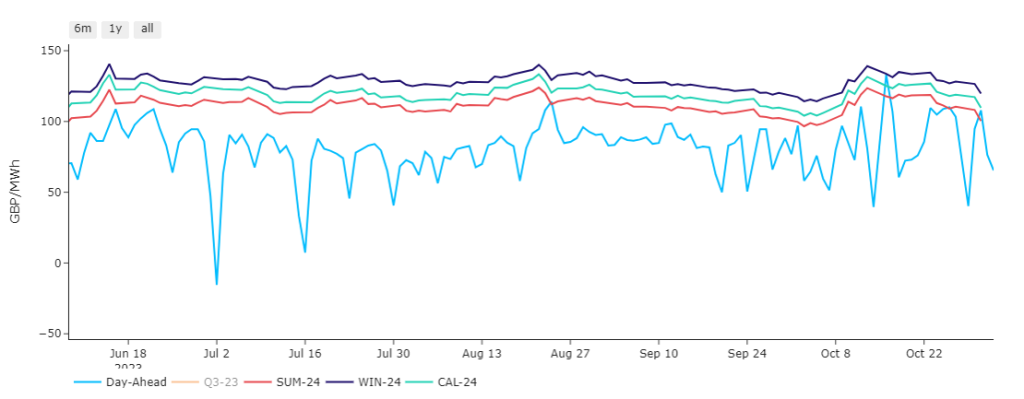

Day-Ahead continues to outperform versus Summer ’24 & Winter ’24 (see chart). On the continent, electricity prices climbed yesterday (supported by weaker solar generation, stronger demand and temporarily lower French nuclear availability) but are expected to fade again today on expectations of improved renewables outputs along with a public holiday in several countries suppressing demand. Long-term delivery prices opened strongly at the beginning of the week on news that Egypt had halted its LNG exports, though quickly reversed all the gains once market participants came to their senses realising the loss of Egypt’s LNG cargos would have little impact on the balance of gas supply whilst wider fundamentals remain benign. Further pressure was then applied by falling carbon and coal prices. Back in the UK, our generation mix today is at 55% renewables (wind and solar); 26 % low carbon (nuclear and imports); 10% fossil fuels (gas and coal). Monthly (N2EX) Day-Ahead averages for Oct ’23 came in at £83/mwh (or 8.3p/kwh). Outlook is neutral to bearish with Summer ’24 delivery prices now offered at a 20% discount versus 6-months ago.

Share

ICD Energy Managers Limited, Q16, Quorum Business Park, Benton Lane, Newcastle Upon Tyne, NE12 8BX

Website hosted by Zaltek Digital