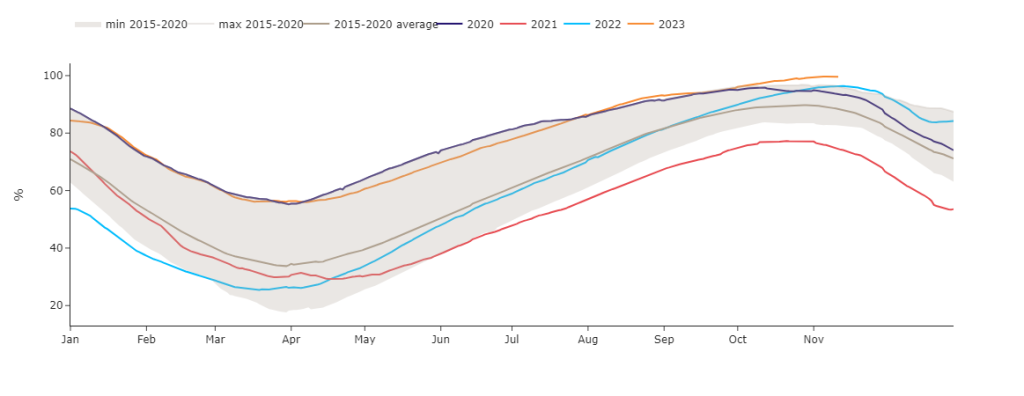

Bearish fundamentals continue to weigh on the front of the curve – with market participants poised to react to changes in weather forecasts or potential gas supply disruptions. The historically high European (and UK) gas storages (see chart) continue to mitigate against supply risk/volatility as we approach the colder months of Q1. Prices are trading in tight ranges across all periods of delivery. It would be fair to say that we’re in a state of balance/equilibrium, with neither bulls nor bears enjoying the lion’s share of momentum! Whilst UK gas prices are marginally up this morning on a slightly short system (demand outstripping supply), LNG arrivals are consistently degasifying at European/UK ports, with the UK expecting another eight vessels before month end and LNG on European waters (waiting for available terminals) having increased around 6% over the last week. The ongoing conflict notwithstanding, Chevron has resumed production at its Tamar gas field In Israel. Bulls momentarily reacted yesterday on news that gas flows to the Freeport LNG terminal (in Texas) are expected to halt today due to “a trip of the Liquefaction Train 3” following a fault with the train’s drive. Though upwards momentum was short-lived as news of improved flows from Norway lifted spirits (currently comfortably above its 5-day moving average). Monthly Day-Ahead averages are on track to achieve 101p/therm (or 3.44p/kwh) for November. Near and far-term delivery prices are down on the week, month, 3-months ago, 6-months ago. To put it another way, it’s certainly bucking the trend to have lower year-ahead prices in November than was the case in April! A reflection surely of the realisation amongst market participants that the Ukraine and Gazan conflicts are increasingly unlikely to impact on European supply security as we approach the business-end of Winter ’23 conditioning…

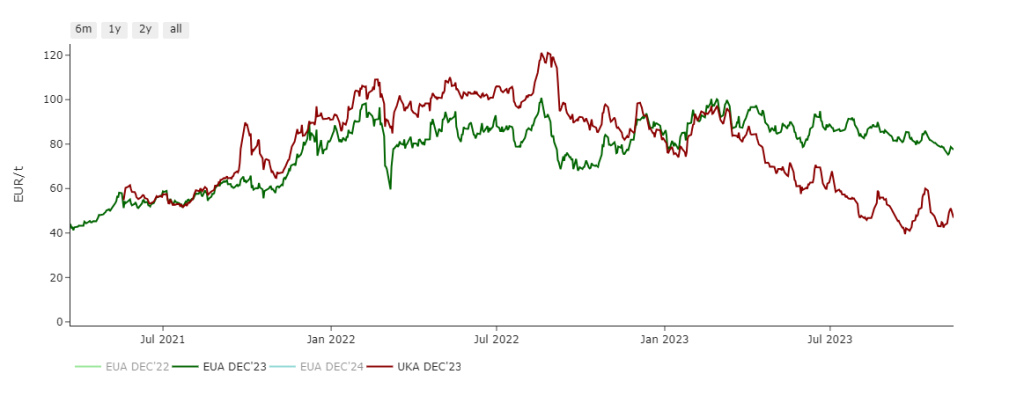

On the continent, European short-term delivery power prices dropped yesterday on forecasts of yet another surge of solid wind outputs, improved solar generation and a jump in French nuclear availability. UK Carbon (UKETS) has fallen back to £40/tonne following last week’s brief recovery against a backdrop of improved renewables generation with prices at the next fortnightly auction expected to settle sub-£40/tonne. The UK Carbon market continues to significantly undercut its European counterpart, as has been the case since the turn of the year (see chart). Today’s generation mix is more evenly split between fossil fuels and renewables than has been the case over the last week, with gas (and coal) generation making up 38%, and wind/solar/hydro accounting for 32%. Temperatures extending beyond mid-month are forecast to be above seasonal norms alongside steady wind outputs which will no doubt limit gas for power burn (and the need for gas storage withdrawals). Monthly Day-Ahead averages are on track to achieve £87/mwh (or 8.7p/kwh) for November.

Share

ICD Energy Managers Limited, Q16, Quorum Business Park, Benton Lane, Newcastle Upon Tyne, NE12 8BX

Website hosted by Zaltek Digital